– Reviewed by James Stanley, Nov. 24, 2021

A forex trading journal is a log of your trades that can help you refine your strategies based on learning from previous experiences. Just as a business owner tracks inventory, a trader should also keep up with their closed positions.

While keeping a trading journal may be difficult at first, recording your trades can help answer some critical questions about your trading techniques. It can increase the consistency of your trading, keep you accountable, and improve your technique overall. In this piece we will explore what you need to know about journaling, providing the following:

- A forex trading journal Excel template

- Tips on finding the journaling method that suits you

- Tips on the ideal forex trading workflow.

Forex Trading Journal Excel

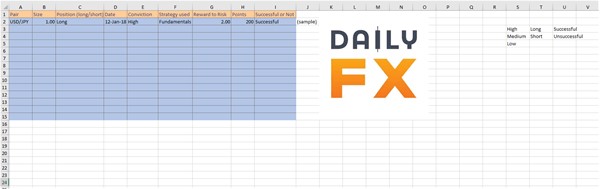

Screenshot showing a forex trading journal template

As in the forex trading journal Excel example above, your journal might contain information such as the currency pair traded, size of the trade, whether your position is long or short, the date of the trade, your conviction level, whether you’ve used a fundamental or technical strategy, the reward to risk ratio, points movement, and whether the trade was successful or not.

You may also want to include details such as the entry price, stop price and limit price, as well as lots traded. The more data you keep, the easier it will be to assess your past trades at a later date.

Also, be sure to include space to add notes in your journal. Traders using multiple entry techniques will want to track things such as chart time frames, indicators used, market conditions (range, trend, breakout) and any other information that factors into a trading decision.

Through journals such as the one above, over time the trader will be able to identify characteristics of winning or losing trades.